Debt Settlement companies help struggling consumers reduce their overwhelming debt in a way that’s right for them.

To find a member company of the American Fair Credit Council, search below:

Who We Are

The American Fair Credit Council (AFCC) is the advocate of consumer rights for Americans in financial hardship with unmanageable unsecured debt burdens. We are organized around a few simple and enduring principles.

What We Do

- Support Consumer Rights: The AFCC supports consumers struggling with overwhelming unsecured debt problems.

- Enforce Best Practices: The AFCC defines, promotes, and enforces best practices and high standards for the debt settlement industry.

- Advocate for Consumer-Centric Policies: The AFCC advocates for strong legislative and regulatory environments that protect consumers and their ability to access quality, effective debt settlement options.

SETTING THE STANDARD

The AFCC partners with BSI – a renowned, independent standards certification organization – to ensure companies meet the highest consumer protection and operational standards in the debt settlement space. AFCC members stand on behalf of consumers, confronting their creditors, while representing their best interests and their goal of a debt-free future. Our members partner with their clients to reduce the burden of their debts, designing affordable repayment plans and negotiating with their creditors.

Debt Settlement 101

How it Works

-

Apply

Apply

A consumer contacts a debt settlement company and speaks with an experienced debt settlement consultant. The typical client owes more than $25,000 in unsecured debt and is already behind on at least one, and, in many cases, most of the seven or more accounts they hold. Debt settlement consumers are suffering a severe financial hardship, such as a household loss of income, a medical event or a life event like a divorce. Under FTC rules, the consumer pays nothing to enroll in a debt settlement program.

-

Acceptance

Acceptance

Following an underwriting process, the company creates a personalized plan for the consumer based on their unique financial position. The consumer creates a separate bank account dedicated to addressing their debts; this bank account is, at all times, under the complete control of the consumer: debt settlement companies never touch consumer funds.

-

Negotiate Debt

Negotiate Debt

Once the consumer has set aside sufficient funds in their dedicated account, debt settlement specialists negotiate settlement offers with each of the client’s creditors.

-

Accept Offer

Accept Offer

When the debt settlement company obtains a settlement offer from a consumer’s creditor, the consumer chooses whether or not to accept it. Consumers are under no obligation to accept any settlement, and, under FTC rules, can reject it without being charged anything.1 The average consumer’s first account is settled four to six months after enrollment.

-

Debt Decreases

Debt Decreases

If the consumer accepts a settlement, payment to that creditor will be made from the consumer’s dedicated account. Only when the consumer has made at least one payment in furtherance of a settlement offer will the consumer be charged a fee, and that fee may only be assessed for the one debt for which a settlement has been agreed.

-

Repeat Process

Repeat Process

The process restarts for each of the consumer’s creditors until each account is settled. No fees are charged until each settlement is agreed to by the customer. Consumers can withdraw from the debt settlement process at any time, for any reason, without penalty – they are totally in control throughout the entire process.

Economic Impact Report 2020

Second Edition

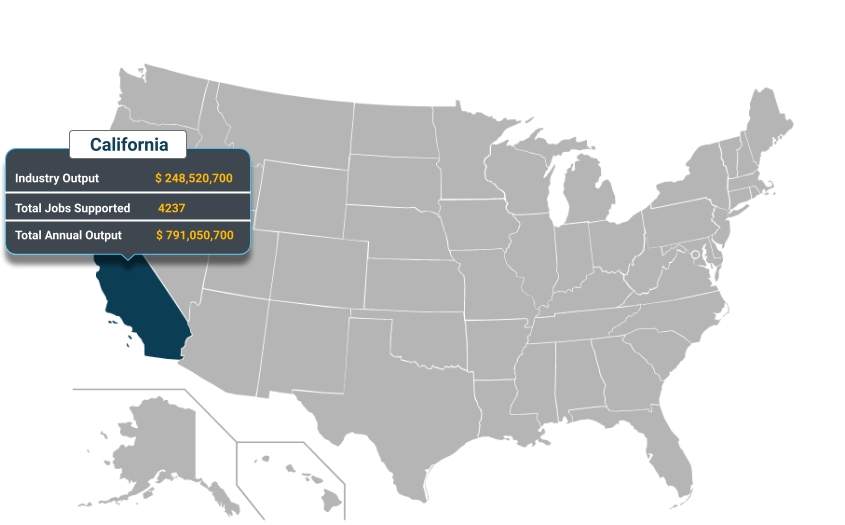

After releasing an extensive study of the debt settlement industry and its vast contributions to the economies of dozens of states and the United States at large, the American Fair Credit Council (AFCC) in 2020 commissioned another independent research study to again assess the national economic impact of debt settlement activity. Using the same research firm, John Dunham & Associates (JDA), data was collected from across the United States to illustrate the debt settlement industry’s substantial positive impact on the U.S. economy and the hundreds of thousands of Americans who have taken advantage of debt settlement.1

The industry contributes to the American economy in a variety of ways, three of which are particularly profound. First, the debt settlement industry employs thousands upon thousands of Americans across the country. Second, creditors participating in the debt settlement process receive funds from debtors faster than they would otherwise. Finally, and most importantly, consumers with crippling unsecured debt enrolled in debt settlement programs are able to get back on their feet rapidly and once again contribute positively to their local economies.

Read More

The Regan Report 2020

Fourth Edition

Options for Consumers in Crisis: An Economic Analysis of the Debt Settlement Industry

The most recent independent “Regan Report” is the fourth in the series overseen by Greg Regan of Hemming Morse LLP. By analyzing the outcomes of 11.4 million individual accounts, the report exemplified how debt settlement serves consumers in financial hardship each day by offering significant and measurable financial benefits.

This latest iteration of the “Regan Report” also quantified the immense benefits debt settlement provides to Americans struggling with unsecured debt by illustrating the significant economic benefit for financially challenged consumers as measured by a cross-section of outcomes including debt reduction, debt reduction per dollar of fees, and ultimately, savings.

Read More

View All Reports

The American Fair Credit Council has placed a high priority on producing relevant and independent data to examine the incredible impact the debt settlement industry has not only on consumers and clients but also the economies of states and the country as well. Several studies commissioned by the AFCC have done a deep dive into these subjects:

- Support Consumer Rights: The AFCC supports consumers struggling with overwhelming unsecured debt problems.

- Enforce Best Practices: The AFCC defines, promotes, and enforces

best practices and high standards for the debt settlement industry. - Advocate for Consumer-Centric Policies: The AFCC advocates for strong legislative and regulatory environments that protect consumers and their ability to access quality, effective debt settlement options.

2023 Spring Conference

Four Seasons Hotel - Orlando, FL May 8th - 10th, 2023AFCC conferences are the debt resolution industry’s premier events for networking, driving innovation and advocacy, and sharing best practices. Registration for our 2023 Spring Conference at Four Seasons Resort – Orlando, FL guarantees you access to engaging speakers, high-energy networking events, and access to the industry’s top vendors. Amplify your voice and help shape the future of debt resolution for our companies and our customers. Join us May 8-10, 2023 at the Four Seasons Resort – Orlando, FL.

Visit Conference PageGet in Touch with Us.