Fall 2015 – Las Vegas, NV

Conference Details

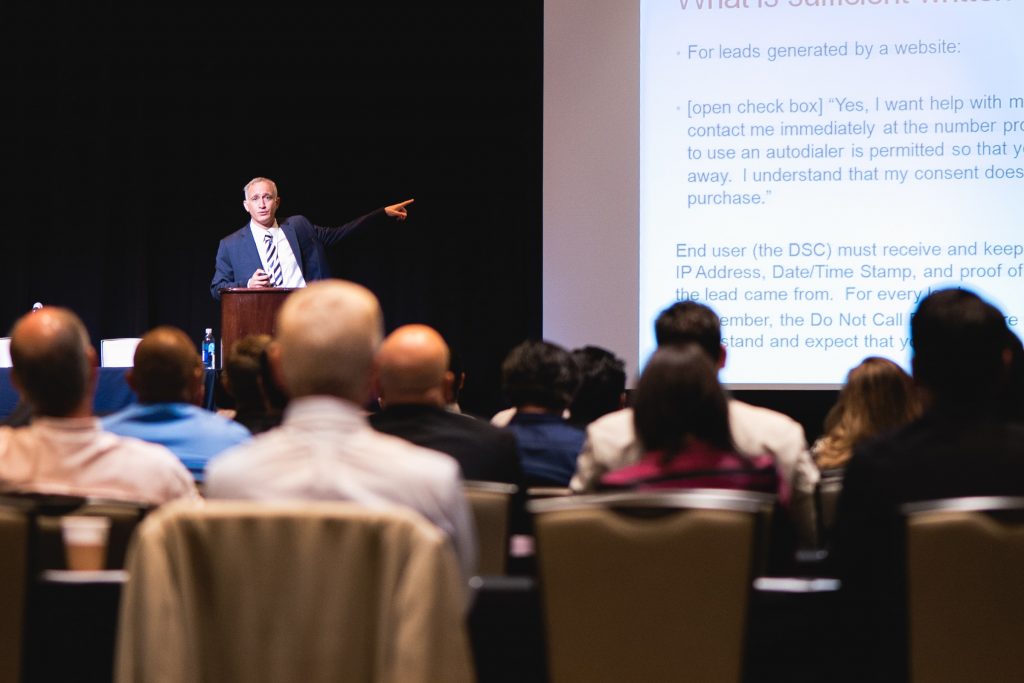

The Fall 2015 AFCC Conference took place at the The Palms Resort in Las Vegas, Nevada. Over 250 professionals in the debt settlement industry attended the 3-day conference to hear a packed agenda full of knowledgeable speakers on multiple aspects of the industry. Robby Birnbaum, AFCC President and a leading expert on debt settlement compliance and regulation, provided a timely update on what every attendee needs to know to run their business in a safe and compliant manner. Mr. Birnbaum reviewed the current status of state laws, consumer protections, the approaches and what to expect from the CFPB, FTC and state regulators. Mr. Birnbaum also addressed the latest licensing requirements for the industry and marketing practices and the compliance concerns around these practices.

Event Agenda Details

-

4:00 pm-5:00 pm

Registration

-

5:00 pm-7:00 pm

AFCC Opening Cocktail Reception

-

8:00 am-8:45 am

Breakfast

-

8:45 am-9:45 am

AFCC Federal and State Legislative Update

The leading expert on debt settlement compliance and regulation will provide a timely update on what every attendee needs to know to run their business in a safe and compliant manner. Mr. Birnbaum, the President of the American Fair Credit Council, will review the current status of state laws, consumer protection, the approaches and what to expect from the CFPB, FTC and state regulators; and the latest licensing requirements for the industry.

Mr. Birnbaum will also review new marketing approaches and their compliance requirements. -

9:45 am-10:15 am

Networking Break (Bloody Mary & Mimosa Bar)

-

10:15 am-11:15 am

KEYNOTE SPEAKER: CFPB and the Debt Settlement Industry (Live, not Skype)

John McNamara will discuss the latest actions that have taken place in the debt settlement

industry post TSR. As well as the current activities and expectations of the Bureau pertains to debt settlement and collection industries. John is an expert on debt collection practices and as a liaison between the CFPB and both the collection industry and consumer advocates. -

11:15 am -12:00 am

FICO Scores: Understanding What a FICO Score Really Means?

We will be discussing what impacts and consumers FICO score both positive and negative, and also getting an education on FICO 9.0. What is the likelihood of adoption of FICO 9.0 with the banks and the impact this will have on debt settlement consumers.

-

12:00 am-12:30 pm

The CFPB Arbitration Study: Unlimited Class Action Lawsuits Ahead?

In 2010, Congress authorized the CFPB to perform a study on arbitration agreements and, if warranted, to prohibit or limit the use of arbitration clauses in customer agreements for consumer financial products and services. The CFPB completed its study in February 2015 and is now working on a rule that could prevent or limit the use of arbitration clauses in client agreements. We’ll discuss why this is important and what you should be doing about it now.

-

12:30 pm-1:30 pm

LUNCH

-

Regan Report 2.0 Final Results Are In!

Greg and Bob had presented an update on Regan Report 2.0 at our last conference. The Regan Report 2.0 is now complete and finalized! They will be presenting the final data and conclusions, which indicate even stronger industry performance than originally found from Version 1.0.

-

2:15 pm-3:00 pm

How the Recent Consent Decree with Chase Will Impact Debt Settlement

The recent decree between the CFPB and Chase will impact debt settlement – for the better. Find out how this debt settlement agreement will impact debt settlement companies and consumers. The Chase settlement along with recent rule changes in New York and legislation in California provide a likely roadmap for CFPB debt collection rulemaking. Get an update on structural changes that are likely to occur which will make it easier for debt settlement companies to deliver services to clients.

-

3:00 pm-3:30 pm

Networking Break

-

Negotiations: Strategies That Work for Your Clients

Come to listen and learn from industry experts who oversee the negotiations process from some of the top debt settlement companies. This panel will be discussing how to best negotiate with creditors, credit relationships and strategies that work.

-

4:15 pm-5:00 pm

Myths and Reality of Compliance

Compliance! Compliance! Compliance! We hear these words all the time but was does that really mean and why should Debt Settlement Companies care? Join Todd Langusch, President & CEO, TECH LOCK, Inc. as he provides the “Myths and Reality” of Compliance and shares his experiences as your former “potential client” and why he had to recommend not doing business with several debt settlement companies. In addition, as a DBA International approved auditor, Payment Card Industry Qualified Security Assessor, and a whole bunch of other acronyms…Todd Langusch will provide the “secrets” to Compliance and a roadmap for Debt Settlement Companies to not only keep current business but grow it. He will show you and easy and affordable way to become and stay compliant.

-

5:00 pm-7:00 pm

Happy Hour

-

9:00 am-9:30 am

Continental Breakfast

-

9:30 am-10:00 am

Peer to Peer Lending and How It’s Impacting the Debt Settlement Space

-

10:00 am-10:30 am

Networking Break

-

10:30 am- 11:15 am

Tax Resolution: How to Add This Vertical to Your Business and Providing More Value for Your Clients!

Fresh Start Tax LLC is a nationwide, A+ rated BBB tax resolution firm. In this session you’ll learn how to be able to provide this service to your debt settlement clients that need tax help as well. It’s much easier than you think!

-

11:15 am-11:45 am

The World of Online Advertising and How to Make it Work for Your Business

Adam Sthay will be discussing lead buying, the good, the bad, the ugly! As well as discussing the options you have for hiring a marketing company to handle your online marketing, generating branded advertisements, driving traffic, and creating a seamless transition from advertisement to closed client.

-

11:45 am-12:15 pm

Student Loans- Industry Update

-

12:15 pm-12:30 pm

Closing Remarks

Get in Touch with Us.